Introduction: Why Credit Card Security Matters

Credit card fraud is a global issue that costs consumers and businesses billions of dollars annually. With the rise of digital transactions, including online shopping, mobile payments, and contactless options, the risk of unauthorized access to cardholder data has never been higher.

Protecting your financial information is critical for obvious reasons.

This guide provides actionable strategies to safeguard your credit card data and reduce your vulnerability to credit card fraud.

Common Credit Card Fraud Threats

- Skimming and Shimming Attacks: Skimmers steal magnetic stripe data by attaching devices to card readers. Shimmers are ultra-thin devices inserted into chip readers to capture EMV chip data.

- Phishing Emails: Cybercriminals impersonate trusted institutions to trick users into revealing sensitive card details.

- Data Breaches: Retailers and payment processors can be compromised, exposing millions of cardholder records even with tokenization and PCI DSS compliance.

- Card-Not-Present Fraud: Stolen card details are used to make online purchases without the physical card, making detection more difficult.

Recognizing these scams and schemes is essential to protecting your payment card information. But recognition isn’t a fail-safe. Here are some tangible tips and recommendations to reduce your risk of having your information stolen.

How to Prevent Skimming and E-Skimming

- Inspect Card Readers: Check for loose parts or unusual colors before using ATMs or payment terminals.

- Choose High-Traffic Locations: Use ATMs inside banks or grocery stores with security cameras.

- Cover Your PIN: Shield the keypad when entering your PIN.

- Report Suspicious Devices: Notify store managers or bank staff immediately.

- Avoid E-skimming: Shop only on trusted websites, look for HTTPS encryption, and keep browsers up to date.

In-Person Security Best Practices

- Use Chip or Contactless Payments: Chip cards generate dynamic codes, making them more secure than magnetic stripes.

- Store Cards Securely: Keep physical cards safe and avoid unnecessary sharing.

- RFID Protection: Use RFID-blocking wallets to prevent wireless skimming.

- Card Handling: Avoid handing your card unnecessarily and try to keep it in your sight.

- Dispose of Old Cards Properly: Cut through both the chip and magnetic strip.

Secure Online Shopping Tips

- Shop on Trusted Sites: Navigate only to and from known stores and sites. Look for HTTPS in the browser address bar to confirm a secure connection.

- Avoid Public Wi-Fi: Use a VPN if you must shop on public networks.

- Don’t Save Card Data: Avoid storing card details on websites and use virtual cards instead.

- Use Digital Wallets: Apple Pay and Google Pay convert your card data to non-sensitive tokens, adding security.

- Keep Software Updated: Maintain current browsers to block malicious scripts and e-skimming attacks. Keep your devices, such as your phone and computer, up to date as well.

Strong Passwords and Authentication

• Create Complex Passwords: Use letters, numbers, and symbols. Consider passphrases to increase length!

• Avoid Personal Info: Don’t use birthdays or names.

• Use Password Managers: Securely manage multiple passwords. Avoid reusing passwords by eliminating the need to memorize them.

• Enable Multi-Factor Authentication (MFA): Add extra security with authenticator apps or biometrics.

• Adopt Passkeys: Use passwordless authentication tied to your device and biometrics (like Apple’s FaceID) for enhanced security.

Mobile Payment Security Essentials

• Download Official Apps: Only from trusted sources like the App Store or Google Play.

• Enable Biometric Authentication: Fingerprint or facial recognition adds security.

• Avoid Unsecured Storage: Never store card details in notes or non-secure apps.

• Update Regularly: Keep your mobile device and apps current.

• Use VPN on Public Wi-Fi: Prevent attackers from intercepting your data.

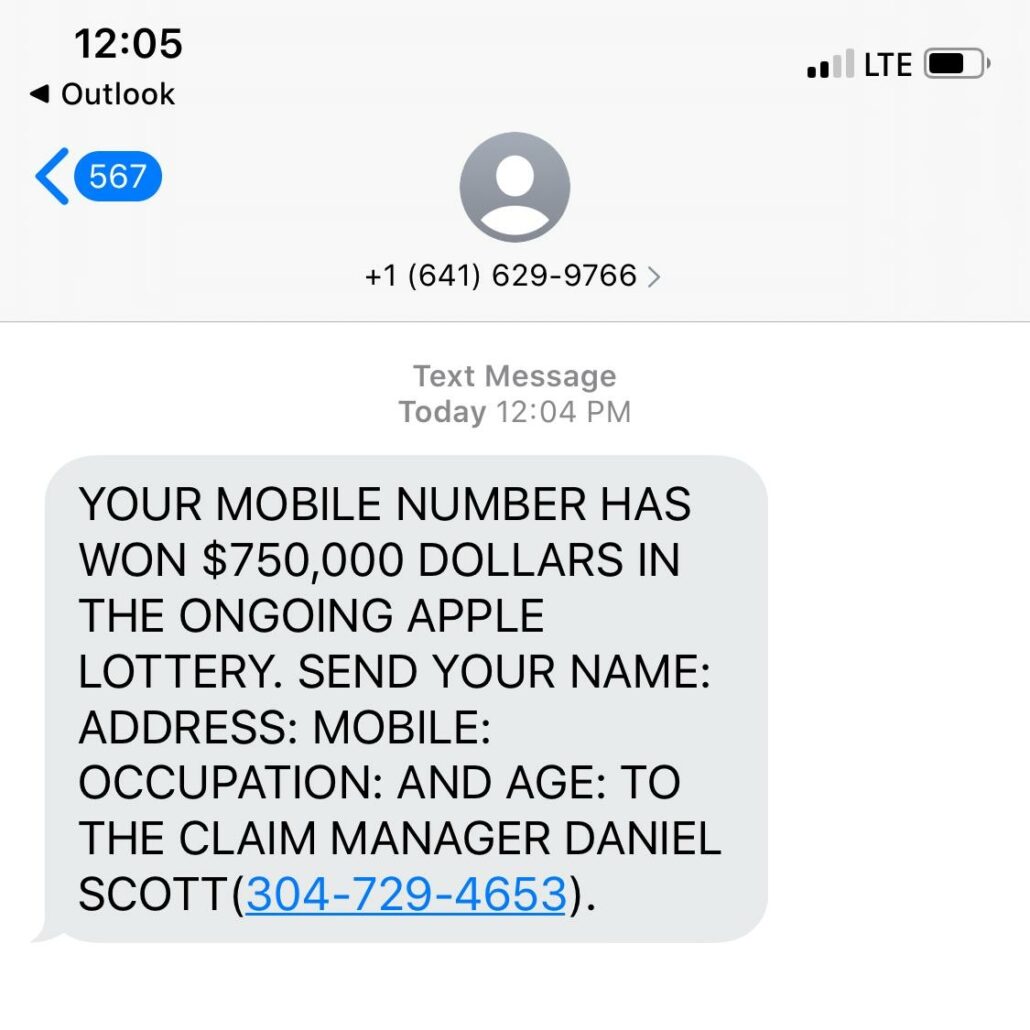

Beware of Phishing Scams

• Stay Alert: Ignore unsolicited emails, texts, or calls requesting card details. Legitimate institutions would never ask for sensitive data this way.

• Verify Directly: If contacted and unsure, reach out to the institution directly using official numbers or emails listed on their website. And navigate to those sites yourself, not using links.

• Never Share Sensitive Data: Only do so if you initiated the contact and have verified the recipient.

Virtual Cards: A Smart Solution

Virtual cards generate temporary numbers for online purchases, reducing the exposure of your real card details. They allow spending limits, expiration dates, and easy deactivation—enabling you to identify compromise quickly and shut the card down without impacting your bank accounts.

General Credit Card Fraud Prevention Tips

• Monitor Transactions: Review statements regularly.

• Set Alerts: Enable notifications for unusual activity.

• Act Fast: Freeze accounts and report fraud immediately to minimize losses.

If you follow these tips and are still compromised, it’s important to understand the requirements placed on cardholder entities as well as on you. Here is what you can expect:

Know Your Liability

• Credit Over Debit: Credit cards generally offer better fraud protection.

• Zero-Liability Policies: Most issuers waive liability for unauthorized charges reported promptly.

• Federal Law: Limits liability to $50, often waived entirely.

• Know Your Rights: Familiarize yourself with your own bank’s fraud policies.

PCI DSS Compliance: Why It Matters

The Payment Card Industry Data Security Standard (PCI DSS) sets global guidelines for merchants and service providers regarding the protection of cardholder data.

It includes 12 core requirements, covering encryption, access control, and continuous monitoring.

In other words, entities that process and store your cardholder data must implement measures to prevent credit card fraud. Compliance scales with transaction volume, and higher tiers require rigorous audits.

This certainly doesn’t absolve you of worry or responsibility, but the guidelines provide customers with assurance that their cardholder data is sufficiently protected.

Final Thoughts

Credit card fraud prevention and security is an ongoing battle between consumers, technology, and criminals.

While advanced features like encryption and tokenization help, personal vigilance remains critical.

By following these best practices, both online and offline, you can significantly reduce your risk of fraud and keep your financial information safe.

And, of course, if you need help with any of these tips and recommendations or need help protecting your business’s cardholder data, don’t hesitate to reach out!